Author: Yannick Fradette

OSISKO MINING PARTICIPATES IN CREATION OF THE OSISKO FIELD EDUCATION FUND

$250,000 Donation to University of New Brunswick

(Toronto – October 10, 2018) Osisko Mining Inc. (the “Company” or “Osisko”) (TSX:OSK) is pleased to announce that together with Osisko Gold Royalties and Osisko Metals Inc. have created the Osisko Field Education Fund in collaboration with the Earth Sciences Department at the University of New Brunswick (“UNB”). Together the three companies have committed to donate a total of $250,000 to the program over the next five years.

The Osisko Field Education Fund is an effort that will yield a direct benefit to students within the Earth Sciences program, helping to fund UNB’s stratigraphy and geological mapping field school courses.

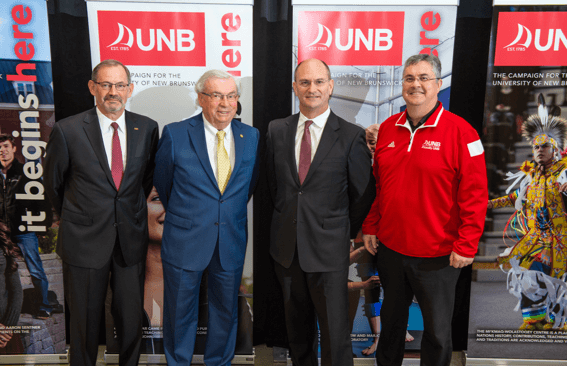

From Left to Right: Dr. Bob Quartermain Campaign Co-Chair, Dr. Mac Watson Campaign Cabinet Member, Jeff Hussey Osisko Metals, President & CEO and UNB Alumnus, and UNB President and Vice-Chancellor Eddy Campbell

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100{4a519b2e1b7ee41c07b52bf609655ec62dee46aaa3d3e6dbc7220444390e11ca} in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100{4a519b2e1b7ee41c07b52bf609655ec62dee46aaa3d3e6dbc7220444390e11ca} undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quevillon area (over 3,300 square kilometres), a 100{4a519b2e1b7ee41c07b52bf609655ec62dee46aaa3d3e6dbc7220444390e11ca} interest in the Marban project located in the heart of Québec’s prolific Abitibi gold mining district, and properties in the Larder Lake Mining Division in northeast Ontario, including the Jonpol and Garrcon deposits on the Garrison property, the Buffonta past producing mine and the Gold Pike mine property. The Corporation also holds interests and options in a number of additional properties in northern Québec and Ontario.

For further information please contact:

John Burzynski

President and Chief Executive Officer

Telephone: (416) 363-8653

OSISKO INTERSECTS 49.1 g/t Au OVER 6.6 METRES AT LYNX

Windfall Infill Drilling Continues to Confirm High-Grade

(Toronto, October 2, 2018) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) is pleased to provide new infill drilling results from the ongoing drill definition and expansion program at its 100% owned Windfall Lake gold project located in the Abitibi greenstone belt, Urban Township, Eeyou Istchee James Bay, Québec. The 800,000 metre drill program commenced in late 2015. The program is currently focussed on infill drilling within the main Windfall gold deposit and the adjacent Lynx deposit (located immediately NE of Windfall), exploration and expansion drilling on the main mineralized zones, and deep hole exploration in the central areas of the intrusive system.

Significant new analytical results from 63 intercepts in 39 drill holes and one wedge focused on infill drilling are presented below.

Highlights from the new results include: 49.1 g/t Au over 6.6 metres in OSK-W-18-1551; 79.9 g/t Au over 2.0 metres in OSK-W-18-1672; 57.6 g/t Au over 2.7 metres in OSK-W-18-1698; 45.5 g/t Au over 3.3 metres in OSK-W-18-1638 and 57.7 g/t Au over 2.1 metres in OSK-W-18-1536-W1. Maps showing hole locations and full analytical results are available at www.osiskomining.com.

| Hole No. | From

(m) |

To

(m) |

Interval

(m) |

Au (g/t)

uncut |

Au (g/t)

cut to 100 g/t |

Type | Mineralized

Zone |

| OSK-W-17-852 | 712.0 | 714.0 | 2.0 | 10.0 | infill | Caribou | |

| including | 712.5 | 715.8 | 0.3 | 42.4 | |||

| OSK-W-18-1454 | 486.8 | 490.1 | 3.3 | 45.5 | infill | Lynx | |

| including | 486.8 | 487.6 | 0.8 | 97.1 | |||

| and | 489.6 | 490.1 | 0.5 | 79.4 | |||

| OSK-W-18-1522 | 271.2 | 275.8 | 4.6 | 11.5 | infill | Lynx | |

| including | 271.2 | 271.8 | 0.6 | 58.1 | |||

| OSK-W-18-1536-W1 | 341.7 | 343.8 | 2.1 | 57.7 | 53.1 | infill | Lynx |

| including | 341.7 | 342.8 | 1.1 | 109 | 100 | ||

| OSK-W-18-1543 | 269.0 | 271.1 | 2.1 | 3.41 | infill | Zone 27 | |

| OSK-W-18-1551 | 249.7 | 256.3 | 6.6 | 49.1 | 33.8 | infill | Lynx |

| including | 253.8 | 255.6 | 1.8 | 154 | 97.5 | ||

| OSK-W-18-1587 | 345.8 | 347.8 | 2.0 | 21.3 | infill | Lynx | |

| including | 345.8 | 346.8 | 1.0 | 40.7 | |||

| OSK-W-18-1627 | 439.6 | 442.0 | 2.4 | 15.2 | Infill | Lynx | |

| OSK-W-18-1630 | 41.9 | 44.0 | 2.1 | 3.59 | infill | Caribou | |

| including | 41.9 | 42.4 | 0.5 | 14.3 | |||

| OSK-W-18-1632 | 47.0 | 49.8 | 2.8 | 5.51 | infill | Caribou | |

| OSK-W-18-1655 | 285.0 | 287.0 | 2.0 | 21.5 | 20.1 | infill | Caribou |

| including | 285.6 | 286.0 | 0.4 | 107 | 100 | ||

| OSK-W-18-1661 | 246.8 | 249.0 | 2.2 | 6.23 | infill | Caribou | |

| including | 247.2 | 247.6 | 0.4 | 29.1 | |||

| OSK-W-18-1662 | 237.0 | 239.0 | 2.0 | 3.55 | infill | Zone 27 | |

| OSK-W-18-1665 | 68.7 | 71.3 | 2.6 | 3.60 | infill | Caribou | |

| including | 71.0 | 71.3 | 0.3 | 15.9 | |||

| OSK-W-18-1667 | 556.8 | 559.0 | 2.2 | 21.7 | infill | Lynx | |

| including | 557.1 | 558.0 | 0.9 | 53.1 | |||

| OSK-W-18-1669 | 54.0 | 56.1 | 2.1 | 4.15 | infill | Caribou | |

| including | 55.3 | 55.8 | 0.5 | 16.0 | |||

| OSK-W-18-1672 | 55.8 | 58.0 | 2.2 | 4.31 | infill | Caribou | |

| 307.1 | 309.1 | 2.0 | 79.9 | 27.1 | infill | Zone 27 | |

| including | 308.6 | 309.1 | 0.5 | 311 | 100 | ||

| OSK-W-18-1673 | 464.0 | 466.0 | 2.0 | 20.4 | infill | Lynx | |

| including | 465.0 | 465.6 | 0.6 | 66.1 | |||

| 473.0 | 476.0 | 3.0 | 7.23 | infill | Lynx | ||

| including | 473.7 | 474.4 | 0.7 | 21.9 | |||

| 479.0 | 481.5 | 2.5 | 7.34 | infill | Lynx | ||

| including | 479.7 | 480.8 | 1.1 | 15.4 | |||

| 518.7 | 521.1 | 2.4 | 25.2 | infill | Lynx | ||

| including | 519.1 | 519.9 | 0.8 | 73.4 | |||

| OSK-W-18-1674 | 340.4 | 343.0 | 2.6 | 3.53 | infill | Zone 27 | |

| OSK-W-18-1675 | 193.8 | 195.8 | 2.0 | 3.63 | infill | Lynx | |

| OSK-W-18-1680 | 91.0 | 94.0 | 3.0 | 10.9 | infill | Caribou | |

| including | 91.0 | 92.0 | 1.0 | 23.1 | |||

| 101.2 | 104.0 | 2.8 | 5.13 | infill | Caribou | ||

| 261.0 | 263.0 | 2.0 | 3.84 | infill | Caribou | ||

| 279.6 | 281.6 | 2.0 | 14.4 | infill | Zone 27 | ||

| including | 279.6 | 280.1 | 0.5 | 52.1 | |||

| 299.1 | 306.6 | 7.5 | 3.21 | infill | Zone 27 | ||

| including | 304.3 | 306.6 | 2.3 | 5.85 | |||

| OSK-W-18-1681 | 517.0 | 519.0 | 2.0 | 11.9 | infill | Lynx | |

| including | 517.5 | 517.8 | 0.3 | 76.9 | |||

| 538.5 | 541.0 | 2.5 | 8.06 | infill | Lynx | ||

| including | 540.0 | 541.0 | 1.0 | 18.9 | |||

| OSK-W-18-1684 | 312.5 | 314.6 | 2.1 | 3.73 | infill | Lynx | |

| OSK-W-18-1685 | 361.0 | 365.1 | 4.1 | 7.01 | infill | Zone 27 | |

| including | 361.0 | 363.0 | 2.0 | 11.9 | |||

| 368.7 | 371.8 | 3.1 | 7.56 | infill | Zone 27 | ||

| including | 369.5 | 370.5 | 1.0 | 19.7 | |||

| 377.5 | 380.0 | 2.5 | 32.3 | infill | Zone 27 | ||

| including | 378.8 | 380.0 | 1.2 | 56.9 | |||

| OSK-W-18-1686 | 124.0 | 126.4 | 2.4 | 9.95 | infill | Zone 27 | |

| including | 125.5 | 125.8 | 0.3 | 47.2 | |||

| OSK-W-18-1687 | 552.8 | 556.0 | 3.2 | 3.49 | infill | Lynx | |

| OSK-W-18-1689 | 67.4 | 70.7 | 3.3 | 6.78 | infill | Zone 27 | |

| including | 67.4 | 68.4 | 1.0 | 16.9 | |||

| 86.4 | 88.4 | 2.0 | 3.62 | infill | Zone 27 | ||

| OSK-W-18-1690 | 17.5 | 20.0 | 2.5 | 6.51 | infill | Zone 27 | |

| including | 17.9 | 18.3 | 0.4 | 24.7 | |||

| OSK-W-18-1691 | 44.9 | 47.0 | 2.1 | 3.30 | infill | Caribou | |

| OSK-W-18-1692 | 114.0 | 116.0 | 2.0 | 18.5 | infill | Caribou | |

| including | 114.4 | 115.0 | 0.6 | 57.9 | |||

| 176.3 | 178.8 | 2.5 | 4.30 | infill | Caribou | ||

| including | 178.0 | 178.8 | 0.8 | 11.4 | |||

| OSK-W-18-1695 | 321.3 | 323.9 | 2.6 | 3.01 | infill | Caribou | |

| including | 321.3 | 321.9 | 0.6 | 9.45 | |||

| 330.0 | 332.3 | 2.3 | 5.39 | infill | Caribou | ||

| including | 330.7 | 331.6 | 0.9 | 13.5 | |||

| 510.1 | 512.2 | 2.1 | 4.57 | infill | Zone 27 | ||

| OSK-W-18-1696 | 127.5 | 131.9 | 4.4 | 3.48 | infill | Lynx | |

| including | 127.5 | 127.8 | 0.3 | 11.9 | |||

| 348.9 | 351.0 | 2.1 | 4.77 | infill | Lynx | ||

| OSK-W-18-1697 | 108.9 | 111.1 | 2.2 | 4.24 | infill | Lynx | |

| including | 109.5 | 110.1 | 0.6 | 15.3 | |||

| OSK-W-18-1698 | 241.8 | 243.8 | 2.0 | 5.75 | infill | Caribou | |

| 246.1 | 248.8 | 2.7 | 57.6 | 50 | infill | Caribou | |

| including | 247.2 | 248.0 | 0.8 | 126 | 100 | ||

| OSK-W-18-1699 | 82.0 | 84.0 | 2.0 | 5.05 | infill | Lynx | |

| 97.9 | 101.4 | 3.5 | 7.26 | infill | Lynx | ||

| 126.3 | 131.9 | 5.6 | 7.25 | infill | Bobcat | ||

| 138.7 | 140.7 | 2.0 | 18.4 | infill | Bobcat | ||

| including | 139.7 | 140.7 | 1.0 | 36.6 | |||

| OSK-W-18-1701 | 186.6 | 188.6 | 2.0 | 29.0 | infill | Bobcat | |

| OSK-W-18-1702 | 293.0 | 295.0 | 2.0 | 30.3 | infill | Caribou | |

| including | 294.0 | 295.0 | 1.0 | 60.5 | |||

| 307.8 | 310.1 | 2.3 | 3.21 | infill | Caribou | ||

| including | 307.8 | 308.4 | 0.6 | 12.1 | |||

| 349.8 | 351.8 | 2.0 | 7.51 | infill | Caribou | ||

| including | 350.8 | 351.8 | 1.0 | 15.0 | |||

| 498.0 | 502.8 | 4.8 | 5.58 | infill | Zone 27 | ||

| OSK-W-18-1704 | 577.0 | 579.0 | 2.0 | 14.2 | infill | Lynx | |

| OSK-W-18-1707 | 268.0 | 270.4 | 2.4 | 3.02 | infill | Caribou | |

| OSK-W-18-1709 | 499.0 | 501.0 | 2.0 | 17.4 | infill | Zone 27 |

Note: True widths are estimated at 65 – 80% of the reported core length interval. See “Quality Control and Reporting Protocols” below.

| Hole Number | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | Section |

| OSK-W-17-852 | 330 | -55 | 1356 | 452874 | 5434552 | 2875 |

| OSK-W-18-1454 | 145 | -53 | 1089 | 453376 | 5435452 | 3750 |

| OSK-W-18-1522 | 331 | -58 | 360 | 453413 | 5434904 | 3525 |

| OSK-W-18-1536-W1 | 337 | -65 | 417 | 453428 | 5434975 | 3575 |

| OSK-W-18-1543 | 327 | -52 | 294 | 452252 | 5434639 | 2375 |

| OSK-W-18-1551 | 335 | -53 | 291 | 453422 | 5434924 | 3550 |

| OSK-W-18-1587 | 332 | -62 | 360 | 453451 | 5435009 | 3600 |

| OSK-W-18-1627 | 141 | -51 | 513 | 453229 | 5435372 | 3600 |

| OSK-W-18-1630 | 330 | -45 | 207 | 452306 | 5434658 | 2425 |

| OSK-W-18-1632 | 329 | -47 | 390 | 452341 | 5434668 | 2475 |

| OSK-W-18-1655 | 351 | -45 | 375 | 452088 | 5434441 | 2150 |

| OSK-W-18-1661 | 353 | -45 | 393 | 452104 | 5434436 | 2150 |

| OSK-W-18-1662 | 6 | -52 | 303 | 452016 | 5434501 | 2100 |

| OSK-W-18-1665 | 347 | -46 | 375 | 452104 | 5434436 | 2150 |

| OSK-W-18-1667 | 141 | -48 | 573 | 453260 | 5435472 | 3675 |

| OSK-W-18-1669 | 3 | -47 | 405 | 452059 | 5434455 | 2125 |

| OSK-W-18-1672 | 345 | -46 | 333 | 452039 | 5434455 | 2100 |

| OSK-W-18-1673 | 135 | -46 | 567 | 453260 | 5435472 | 3675 |

| OSK-W-18-1674 | 345 | -45 | 378 | 452102 | 5434436 | 2150 |

| OSK-W-18-1675 | 136 | -45 | 420 | 453306 | 5435331 | 3625 |

| OSK-W-18-1680 | 332 | -48 | 372 | 452350 | 5434621 | 2450 |

| OSK-W-18-1681 | 143 | -46 | 570 | 453259 | 5435473 | 3675 |

| OSK-W-18-1684 | 143 | -46 | 390 | 453493 | 5435405 | 3825 |

| OSK-W-18-1685 | 330 | -52 | 414 | 452350 | 5434621 | 2450 |

| OSK-W-18-1686 | 141 | -50 | 159 | 452098 | 5434820 | 2325 |

| OSK-W-18-1687 | 141 | -49 | 588 | 453344 | 5435502 | 3750 |

| OSK-W-18-1689 | 150 | -54 | 135 | 452177 | 5434814 | 2400 |

| OSK-W-18-1690 | 142 | -49 | 141 | 452190 | 5434821 | 2400 |

| OSK-W-18-1691 | 338 | -59 | 78 | 452251 | 5434568 | 2350 |

| OSK-W-18-1692 | 329 | -52 | 450 | 452407 | 5434632 | 2500 |

| OSK-W-18-1695 | 329 | -52 | 520 | 452418 | 5434562 | 2475 |

| OSK-W-18-1696 | 142 | -45 | 453 | 453481 | 5435423 | 3825 |

| OSK-W-18-1697 | 328 | -61 | 231 | 453022 | 5434874 | 3175 |

| OSK-W-18-1698 | 329 | -53 | 513 | 452430 | 5434608 | 2525 |

| OSK-W-18-1699 | 327 | -64 | 174 | 452970 | 5434884 | 3125 |

| OSK-W-18-1701 | 328 | -66 | 207 | 452968 | 5434844 | 3100 |

| OSK-W-18-1702 | 330 | -50 | 534 | 452418 | 5434561 | 2475 |

| OSK-W-18-1704 | 137 | -50 | 627 | 453349 | 5435524 | 3775 |

| OSK-W-18-1707 | 329 | -49 | 447 | 452450 | 5434658 | 2550 |

| OSK-W-18-1709 | 330 | -51 | 525 | 452399 | 5434512 | 2450 |

OSK-W-17-852 intersected 10.0 g/t Au over 2.0 metres in Caribou. Mineralization consists of local visible gold, traces pyrite and quartz-carbonate veins hosted in a sericite altered andesite in contact with a felsic porphyritic dike.

OSK-W-18-1454 intersected 45.5 g/t Au over 3.3 metres in Lynx. Mineralization consists of up to 8% pyrite-silica flooding, quartz-tourmaline veins and local visible gold within a sericite, fuchsite and silica altered rhyolite.

OSK-W-18-1522 intersected 11.5 g/t Au over 4.6 metres in Lynx. Mineralization consists of 2% pyrite stringers, trace pyrite clusters and local visible gold within weak pervasive silica flooding hosted in a sericite, silica and fuchsite altered rhyolite.

OSK-W-18-1536-W1 intersected 57.7 g/t Au over 2.1 metres in Lynx. Mineralization consists of 3% pyrite at the contact of quartz-carbonate vein hosted in a chloritized gabbro.

OSK-W-18-1543 intersected 3.41 g/t Au over 2.1 metres in Zone 27. Mineralization consists of local visible gold in a quartz-carbonate vein cross-cutting a large pyrite stringer, 5-7% pyrite stringers hosted in a strongly bleached andesite.

OSK-W-18-1551 intersected 49.1 g/t Au over 6.6 metres in Lynx. Mineralization consists of up to 5% pyrite stringers, 5% disseminated pyrite, pyrite-silica flooding and local visible gold at the contact between a strong silica and moderate fuchsite altered rhyolite and a fragmental felsic dike.

OSK-W-18-1587 intersected 21.3 g/t Au over 2.0 metres in Lynx. Mineralization consists of 10% pyrite-silica flooding, 3% pyrite clusters and quartz-tourmaline veins within strong sericite altered gabbro.

OSK-W-18-1627 intersected 15.2 g/t Au over 2.4 metres in Lynx. Mineralization consists of 1% pyrite stringers, trace disseminated pyrite and quartz-carbonate veins hosted in strong carbonate, weak chlorite altered gabbro.

OSK-W-18-1630 intersected 3.59 g/t Au over 2.1 metres in Caribou. Mineralization consists of 10% semi massive pyrite over 50 centimetres, 3% pyrite stringers, 1% disseminated pyrite hosted in a sericite and silica altered rhyolite.

OSK-W-18-1632 intersected 5.51 g/t Au over 2.8 metres in Caribou. Mineralization consists of 10% pyrite stringer within silica patches and 5% pyrite clusters hosted in a sericite altered felsic porphyritic intrusion.

OSK-W-18-1655 intersected 21.5 g/t Au over 2.0 metres in Caribou. Mineralization consists of 10% disseminated pyrite hosted in a moderate sericite and carbonate altered felsic porphyritic dike.

OSK-W-18-1661 intersected 6.23 g/t Au over 2.2 metres in Caribou. Mineralization consists of up to 20% pyrite stringers, 10% ptygmatic tourmaline veins, and trace sphalerite within a moderate sericite, chlorite and carbonate altered felsic dike.

OSK-W-18-1662 intersected 3.55 g/t Au over 2.0 metres in Zone 27. Mineralization consists of 10% pyrite-tourmaline stringers within a sericite and silica altered rhyolite.

OSK-W-18-1665 intersected 3.60 g/t Au over 2.6 metres in Caribou. Mineralization consists of up to 15% pyrite stringers, 1% pyrite-silica flooding, trace sphalerite and crustiform quartz veins hosted in moderate sericite and chlorite altered rhyolite.

OSK-W-18-1667 intersected 21.7 g/t Au over 2.2 metres in Lynx. Mineralization consists of local visible gold, up to 5% disseminated pyrite stringer with pervasive silica flooding and a crustiform vein hosted in a strong silica and moderate fuchsite altered gabbro.

OSK-W-18-1669 intersected 4.15 g/t Au over 2.1 metres in Caribou. Mineralization consists of 3% pyrite stringers and trace sphalerite within a moderate sericite and silica altered porphyritic felsic dike.

OSK-W-18-1672 intersected 4.31 g/t Au over 2.2 metres in Caribou and 79.9 g/t Au over 2.0 metres in Zone 27. The first interval is composed of trace disseminated pyrite clusters, a 60 centimetre quartz vein hosted in a sericitized porphyritic felsic dike. The second interval is composed of local visible gold with massive pyrite, intense silica flooding, 3% pyrite clusters and 3% pyrite in quartz-tourmaline veins. Mineralization is hosted in a bleached, silicified and strongly sericitized fragmental intrusion.

OSK-W-18-1673 intersected 20.4 g/t Au over 2.0 metres, 7.23 g/t Au over 3.0 metres, 7.34 g/t Au over 2.5 metres and 25.2 g/t Au over 2.4 metres in Lynx. The first interval contains 10% pyrite stringers and 5% pyrite clusters hosted in a strong sericite altered rhyolite. The second interval is composed of 2% pyrite stringers with local pervasive silica flooding at the contact between a gabbro and a rhyolite. The third interval is composed of 4% disseminated pyrite with pervasive silica flooding within a sericite and silica altered rhyolite. The last interval contains 3% disseminated pyrite in pervasive silica flooding, 2% pyrite clusters, 1% pyrite stringers and trace pyrite in a crustiform quartz vein. Mineralization is hosted in a strong silica and weak fuchsite altered gabbro.

OSK-W-18-1674 intersected 3.53 g/t Au over 2.6 metres in Zone 27. Mineralization consists of up to 25% pyrite with tourmaline stringers hosted in a strongly sericitized and bleached andesite.

OSK-W-18-1675 intersected 3.63 g/t Au over 2.0 metres in Lynx. The interval contains up to 10% disseminated pyrite, stringers and clusters with pervasive silica flooding in a strong silica and moderate sericite altered fragmental felsic intrusion.

OSK-W-18-1680 intersected five intervals: 10.9 g/t Au over 3.0 metres, 5.13 g/t Au over 2.8 metres and 3.84 g/t Au over 2.0 metres in Caribou; 14.4 g/t Au over 2.0 metres and 3.21 g/t Au over 7.5 metres in Zone 27. The first interval is composed of 5% pyrite in fracture filling, 1% pyrite and trace sphalerite with quartz-carbonate veins and traces disseminated pyrite hosted in a faulted, moderate fuchsite and patchy silica altered rhyolite. The second interval contains 25% pyrite in a semi-massive band, 2% pyrite with pervasive silica flooding in a silicified rhyolite. The third interval is composed of 1% pyrite-tourmaline stringers, trace pyrite with quartz clusters hosted in a sericite altered porphyritic felsic dike. The fourth interval is composed of 2% disseminated pyrite and tourmaline within a moderate to strong sericite altered rhyolite. The last interval contains 8% pyrite disseminated and clusters, 3% pyrite stringers and trace chalcopyrite within quartz-carbonate veins hosted in strong sericite altered rhyolite and felsic porphyritic dike.

OSK-W-18-1681 intersected 11.9 g/t Au over 2.0 metres and 8.06 g/t Au over 2.5 metres in Lynx. The first interval contains up to 5% disseminated pyrite in quartz-tourmaline veins and ptygmatic tourmaline veinlets hosted in a silicified gabbro. The second interval contains up to 3% pyrite-silica flooding within strong silica and moderate fuchsite altered gabbro.

OSK-W-18-1684 intersected 3.73 g/t Au over 2.1 metres in Lynx. Mineralization consists of 5% disseminated pyrite with 10% quartz clusters hosted in a moderate chlorite and carbonate altered gabbro.

OSK-W-18-1685 intersected three intervals in Zone 27: 7.01 g/t Au over 4.1 metres, 7.56 g/t Au over 3.1 metres and 32.3 g/t Au over 2.5 metres. The first interval consists of 7% disseminated pyrite and trace pyrite stringer in a strongly bleached and sericitized andesite. The second interval is composed of 7% disseminated pyrite and trace pyrite stringers hosted in a moderate sericite altered felsic porphyritic intrusion. The last interval contains 10% pyrite clusters, 1% pyrite stingers and trace pyrite-tourmaline stringers hosted in a moderate chlorite and sericite altered andesite.

OSK-W-18-1686 intersected 9.95 g/t Au over 2.4 metres in Zone 27. Mineralization consists of 50% semi-massive pyrite and 5% disseminated sphalerite with fragmental quartz-carbonate veinlets hosted in a sericitized and silicified fragmental felsic dike and rhyolite.

OSK-W-18-1687 intersected 3.49 g/t Au over 3.2 metres in Lynx. Mineralization consists of up to 5% pyrite hosted in two crustiform veins of 10 and 20 centimetres wide within a moderate sericite and moderate fuchsite altered gabbro.

OSK-W-18-1689 intersected 6.78 g/t Au over 3.3 metres and 3.62 g/t Au over 2.0 metres in Zone 27. Both intervals contain up to 30% pyrite and pyrite-tourmaline stringers hosted in silica and sericite altered felsic porphyritic intrusion in contact with a rhyolite.

OSK-W-18-1690 intersected 6.51 g/t Au over 2.5 metres in Zone 27. Mineralization consists of up to 15% pyrite stringers with disseminated tourmaline hosted in silicified rhyolite.

OSK-W-18-1691 intersected 3.30 g/t Au over 2.1 metres in Caribou. Mineralization is composed of 1% pyrite stringers and traces disseminated pyrite in a bleached and sericitized andesite.

OSK-W-18-1692 intersected 18.5 g/t Au over 2.0 metres and 4.30 g/t Au 2.5 metres in Caribou. The first interval contains 7% pyrite and trace sphalerite infilling fractures within a fault zone hosted in a felsic porphyritic intrusion. The second interval contains up to 5% pyrite stringers, 1% pyrite associated with pervasive silica flooding, 1% pyrite in fractures filling within faulted, moderate sericite altered rhyolite.

OSK-W-18-1695 intersected three intervals: 3.01 g/t Au over 2.6 metres, 5.39 g/t Au over 2.3 metres in Caribou and 4.57 g/t Au over 2.1 metres in Zone 27. The first interval contains 5% pyrite stringers and 30% massive pyrite in a decimetre-scale band hosted in a silica and sericite altered rhyolite in contact with a bleached andesite. The second interval is composed of 10% pyrite stringers hosted in moderate bleach, weak chlorite and silica altered andesite. The last interval contains 10% pyrite with pervasive silica flooding, pyrite stockwork with disseminated tourmaline and 15% massive pyrite over 25 centimetres hosted in strongly silicified and bleached andesite.

OSK-W-18-1696 intersected 3.48 g/t Au over 4.4 metres and 4.77 g/t Au over 2.1 metres in Lynx. The first interval contains up to 7% pyrite with quartz carbonate veins, up to 5% pyrite stringers, 3% disseminated pyrite and 3% pyrite fragments hosted in a bleached, sericitized and fuchsite altered gabbro. The second interval contains up to 15% fine-grained pyrite stringers, trace pyrite-tourmaline stringers, 2% pyrite clusters with local quartz-carbonate veinlets hosted in a moderate chlorite, sericite and fuchsite altered gabbro.

OSK-W-18-1697 intersected 4.24 g/t Au over 2.2 metres in Lynx. Mineralization consists of up to 5% disseminated pyrite in strong pervasive silica alteration and within 20 centimetre wide crustiform vein hosted in a porphyritic felsic dike.

OSK-W-18-1698 intersected two intervals in Caribou: 5.75 g/t Au over 2.0 metres and 57.6 g/t Au over 2.7 metres. The first interval contains up to 5% pyrite stringers with pervasive silica flooding and 1% disseminated pyrite within strong silica and sericite altered rhyolite in contact with a felsic dike. The second interval contains up to 5% interstitial pyrite with pervasive silica flooding hosted in a moderate sericite altered porphyritic felsic dike.

OSK-W-18-1699 intersected four intervals: 5.05 g/t Au over 2.0 metres and 7.26 g/t Au over 3.5 metres in Lynx; 7.25 g/t Au over 5.6 metres and 18.4 g/t au over 2.0 metres in Bobcat. The first interval is composed of up to 5% disseminated pyrite and clusters with moderate pervasive silica alteration in 2 metre wide crustiform vein at the contact with a felsic dike. The second interval contains up to 10% pyrite-silica flooding, and quartz crustiform veins within a strong silica altered felsic dike. The third interval contains up to 10% disseminated pyrite in a strong silica alteration overprinted by quartz crustiform vein in a gabbro. The last interval contains trace disseminated pyrite and quartz-carbonate vein in a strongly chloritized gabbro.

OSK-W-18-1701 intersected 29.0 g/t Au over 2.0 metres in Bobcat. Mineralization consists of up to 5% pyrite-silica flooding within a strong silica altered felsic porphyritic intrusion.

OSK-W-18-1702 intersected four intervals: 30.3 g/t Au over 2.0 metres, 3.21 g/t Au over 2.3 metres and 7.51 g/t Au over 2.0 metres in Caribou; and 5.58 g/t au over 4.8 metres in Zone 27. The first interval is composed of traces pyrite stringer and pyrite-tourmaline stringer in a moderate sericite altered rhyolite. The second interval contains 8% disseminated pyrite within a moderate chlorite altered rhyolite. The third interval contains 1% disseminated pyrite within weak sericite altered andesite. The last interval contains up to 10% pyrite stringers, 2% ptygmatic tourmaline veins and local visible gold hosted at the contact between a moderate bleach, sericite and silica altered andesite and a felsic dike.

OSK-W-18-1704 intersected 14.2 g/t Au over 2.0 metres in Lynx. Mineralization consists of up to 10% disseminated pyrite and 2% pyrite stringers within moderate chlorite, weak silica and sericite altered gabbro.

OSK-W-18-1707 intersected 3.02 g/t Au over 2.4 metres in Caribou. Mineralization consists of up to 10% pyrite with quartz veins hosted in a moderate chlorite altered gabbro.

OSK-W-18-1709 intersected 17.4 g/t Au over 2.0 metres in Zone 27. Mineralization consists of 10% pyrite clusters and 3% pyrite stringers within a moderate sericite and weak silica altered felsic porphyritic intrusion.

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared and approved by Mr. Louis Grenier, M.Sc.A., P.Geo. (OGQ 800), Project Manager of Osisko’s Windfall Lake gold project, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Control and Reporting Protocols

True width determination is currently unknown but is estimated at 65-80% of the reported core length interval for the zone. Assays are uncut except where indicated. Intercepts occur within geological confines of major zones but have not been correlated to individual vein domains at this time. Reported intervals include minimum weighted averages of 3.0 g/t Au diluted over core lengths of at least 2.0 metres. All NQ core assays reported were obtained by either 1-kilogram screen fire assay or standard 50-gram fire-assaying-AA finish or gravimetric finish at (i) ALS Laboratories in Val d’Or, Québec, Thunder Bay, Ontario, Sudbury, Ontario or Vancouver, British Colombia, or (ii) Bureau Veritas in Timmins, Ontario. The 1-kilogram screen assay method is selected by the geologist when samples contain coarse gold or present a higher percentage of pyrite than surrounding intervals. Selected samples are also analyzed for multi-elements, including silver, using an Aqua Regia-ICP-AES method at ALS Laboratories. Drill program design, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results is performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QA/QC purposes by the Corporation as well as the lab. Approximately 5% of sample pulps are sent to secondary laboratories for check assay.

About the Windfall Lake Gold Deposit

The Windfall Lake gold deposit is located between Val-d’Or and Chibougamau in the Abitibi region of Québec, Canada. The mineral resource defined by Osisko, as disclosed in the Windfall Lake Technical Report (as defined below), comprises 2,382,000 tonnes at 7.85 g/t Au (601,000 ounces) in the indicated mineral resource category and 10,605,000 tonnes at 6.70 g/t Au (2,284,000 ounces) in the inferred mineral resource category. For details regarding the key assumptions, parameters and methods used to estimate the mineral resources presented in respect of the Windfall Lake gold project, please see the technical report entitled “Technical Report and Mineral Resource Estimate for the Windfall Lake Project, Windfall Lake and Urban-Barry Properties” and dated June 12, 2018 (effective date of May 14, 2018), which has been prepared by InnovExplo Inc. from Val-d’Or, Québec (the “Windfall Lake Technical Report”). The Windfall Lake Technical Report is available on Osisko’s website at www.osiskomining.com and on SEDAR under Osisko’s issuer profile at www.sedar.com). The Windfall Lake gold deposit is currently one of the highest grade resource-stage gold projects in Canada. Mineralization occurs in four principal zones: Lynx, Zone 27, Caribou and Underdog. All zones comprise sub-vertical lenses following intrusive porphyry contacts plunging to the northeast. The deposit is well defined from surface to a depth of 900 metres and remains open along strike and at depth. Mineralization has been identified 30 metres from surface in some areas and as deep as 2000 metres in others, with significant potential to extend mineralization down-plunge and at depth.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100% undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quevillon area (over 3,300 square kilometres), a 100% interest in the Marban project located in the heart of Québec’s prolific Abitibi gold mining district, and properties in the Larder Lake Mining Division in northeast Ontario, including the Jonpol and Garrcon deposits on the Garrison property, the Buffonta past producing mine and the Gold Pike mine property. The Corporation also holds interests and options in a number of additional properties in northern Québec and Ontario.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the Windfall Lake gold deposit being one of the highest grade resource-stage gold projects in Canada; the Windfall Lake gold deposit being a world-class gold system; the significance of new results from the ongoing deep-hole drill/exploration program at the Windfall Lake gold project; the significance of assay results presented in this news release; potential depth extensions of the Lynx and Underdog mineralized zones; the potential, if any of the Deep Underdog and Deep Lynx zones; the type and extend of drilling on the Deep Underdog and Deep Lynx zones, including planned wedge holes; the success of Osisko’s deep-hole drill/exploration program at the Windfall Lake gold project, if any; the down-plunge projection of the gold mineralized structures; the current 800,000 metre drill program; the type of drilling included in the drill program; potential mineralization; the potential to extend mineralization up and down-plunge and at depth at the Windfall Lake gold deposit; the ability to realize upon any mineralization in a manner that is economic; the ability to complete any proposed exploration activities and the results of such activities, including the continuity or extension of any mineralization; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Osisko to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including drilling; property interests in the Windfall Lake gold project; the ability of the Corporation to obtain required approvals and complete transactions on terms announced; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions. Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information, Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski

President and Chief Executive Officer

Telephone: (416) 363-8653

OSISKO INTERSECTS 37.0 g/t Au OVER 5.4 METRES AT OSBORNE-BELL

Infill Drilling Continues to Confirm High-Grade

(Toronto, September 28, 2018) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) is pleased to provide new results from the ongoing infill drilling program at its 100% owned Osborne-Bell gold deposit located 15 kilometres northwest of the town of Lebel-sur-Quévillon, Québec. The 50,000-metre program combines definition and expansion drilling at Osborne-Bell and the surrounding Quévillon property area. The Osborne-Bell deposit remains open at depth. To date approximately 24,100 metres of infill drilling have been completed over the main Osborne-Bell deposit.

Significant new analytical results from 22 intercepts in 18 drill holes are presented below. Highlights from the new results include: 37.0 g/t Au over 5.4 metres in OSK-OB-18-051; 38.6 g/t Au over 2.5 metres in OSK-OB-18-011; 41.1 g/t Au over 2.4 metres in OSK-OB-18-086 and 26.6 g/t Au over 4.6 metres in OSK-OB-18-010. Maps showing hole locations and full analytical results are available at www.osiskomining.com.

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) uncut | Au (g/t) cut to 100 g/t | Type | Mineralized Zone |

| OSK-OB-18-010 | 144.7 | 149.3 | 4.6 | 26.6 | infill | 2-650 | |

| including | 144.7 | 146.0 | 1.3 | 43.8 | |||

| OSK-OB-18-011 | 171.0 | 176.3 | 5.3 | 5.25 | infill | 2-650 | |

| including | 174.0 | 175.0 | 1.0 | 12.3 | |||

| OSK-OB-18-011 | 195.7 | 198.2 | 2.5 | 38.6 | 29.0 | infill | 2-650 |

| including | 195.7 | 196.4 | 0.7 | 135 | 100 | ||

| OSK-OB-18-019 | 425.0 | 428.0 | 3.0 | 15.2 | infill | 2-652 | |

| OSK-OB-18-023 | 287.0 | 289.0 | 2.0 | 13.0 | Infill | 2-651 | |

| OSK-OB-18-043 | 149.5 | 155.8 | 6.3 | 10.9 | infill | 2-650 | |

| including | 155.0 | 155.8 | 0.8 | 52.3 | |||

| OSK-OB-18-051 | 167.6 | 173.0 | 5.4 | 37.0 | 34.7 | infill | 2-652 |

| including | 170.0 | 171.0 | 1.0 | 113 | 100 | ||

| OSK-OB-18-055 | 59.9 | 62.9 | 3.0 | 11.8 | infill | 2-651 | |

| including | 59.9 | 60.9 | 1.0 | 18.8 | |||

| OSK-OB-18-057 | 105.6 | 107.7 | 2.1 | 26.4 | infill | 2-650 | |

| OSK-OB-18-064 | 117.6 | 121.0 | 3.4 | 7.26 | infill | 2-651 | |

| including | 117.6 | 118.6 | 1.0 | 19.8 | |||

| OSK-OB-18-069 | 129.0 | 138.0 | 9.0 | 6.18 | infill | 2-652 | |

| including | 131.1 | 132.2 | 1.1 | 26.9 | |||

| OSK-OB-18-070 | 134.0 | 136.1 | 2.1 | 38.0 | infill | 2-652 | |

| OSK-OB-18-070 | 138.9 | 142.2 | 3.3 | 14.2 | infill | 2-652 | |

| OSK-OB-18-073 | 128.2 | 132.3 | 4.1 | 8.20 | infill | 2-652 | |

| including | 130.4 | 131.0 | 0.6 | 38.0 | |||

| OSK-OB-18-073 | 136.7 | 139.3 | 2.6 | 29.4 | infill | 2-652 | |

| including | 137.0 | 137.3 | 0.3 | 92.4 | |||

| OSK-OB-18-075 | 175.0 | 178.0 | 3.0 | 19.6 | infill | 2-652 | |

| including | 175.0 | 175.8 | 0.8 | 52.5 | |||

| OSK-OB-18-077 | 132.2 | 134.5 | 2.3 | 8.28 | infill | 3-653 | |

| including | 132.5 | 133.0 | 0.5 | 18.4 | |||

| OSK-OB-18-082 | 168.5 | 174.5 | 6.0 | 3.32 | infill | 3-653 | |

| OSK-OB-18-086 | 208 | 210.4 | 2.4 | 41.1 | 39.1 | infill | 3-551 |

| including | 208.0 | 209.0 | 1.0 | 95.0 | 90.2 | ||

| OSK-OB-18-088 | 102.7 | 109.4 | 6.7 | 3.90 | infill | 3-654 | |

| including | 103.9 | 104.4 | 0.5 | 21.8 | |||

| OSK-OB-18-088 | 152.9 | 156.0 | 3.1 | 11.0 | infill | 3-653 | |

| including | 152.9 | 153.3 | 0.4 | 79.6 | |||

| OSK-OB-18-098 | 15.9 | 18.3 | 2.4 | 13.4 | infill | 3-652 | |

| including | 15.9 | 17.0 | 1.1 | 27.2 |

| Hole Number | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | Section |

| OSK-OB-18-010 | 204 | -63 | 232 | 340985 | 5444043 | 1975E |

| OSK-OB-18-011 | 196 | -53 | 274 | 341027 | 5444098 | 2000E |

| OSK-OB-18-019 | 196 | -62 | 565 | 341140 | 5444258 | 2075E |

| OSK-OB-18-023 | 189 | -53 | 450 | 341057 | 5444209 | 2000E |

| OSK-OB-18-043 | 199 | -65 | 210 | 341005 | 5444053 | 2000E |

| OSK-OB-18-051 | 181 | -60. | 204 | 341098 | 5444097 | 2075E |

| OSK-OB-18-055 | 196 | -49. | 136 | 340953 | 5444027 | 1950E |

| OSK-OB-18-057 | 187 | -58 | 126 | 340922 | 5444024 | 1925E |

| OSK-OB-18-064 | 196 | -47 | 204 | 340967 | 5444091 | 1950E |

| OSK-OB-18-069 | 194 | -51 | 200 | 341069 | 5444124 | 2025E |

| OSK-OB-18-070 | 194 | -52 | 168 | 341088 | 5444119 | 2050E |

| OSK-OB-18-073 | 193 | -55 | 182 | 341115 | 5444096 | 2075E |

| OSK-OB-18-075 | 194 | -50 | 210 | 341217 | 5444117 | 2175E |

| OSK-OB-18-077 | 196 | -48 | 216 | 341265 | 5444131 | 2225E |

| OSK-OB-18-082 | 196 | -47 | 209 | 341447 | 5444042 | 2425E |

| OSK-OB-18-086 | 182 | -47 | 303 | 341464 | 5444076 | 2425E |

| OSK-OB-18-088 | 195 | -47 | 192 | 341461 | 5444017 | 2425E |

| OSK-OB-18-098 | 191 | -45 | 71 | 341239 | 5443973 | 2250E |

OSK-OB-18-010 intersected zone 2-650 averaging 26.6 g/t Au over 4.6 metres. Mineralization consists of local visible gold, up to 5% finely disseminated pyrite and trace pyrrhotite in an andesite with weak carbonate alteration.

OSK-OB-18-011 intersected 5.25 g/t Au over 5.3 metres and 38.6 g/t Au over 2.5 metres in zone 2-650. Mineralization consist of up to 10% clustered pyrite in a fragmented andesite with irregular felsic fragments.

OSK-OB-18-019 intersected 15.2 g/t Au over 3.0 metres in zone 2-652. The interval contains 2% disseminated pyrite in a felsic volcanic rock with moderate sericite and potassic alteration.

OSK-OB-18-023 intersected 13.0 g/t Au over 2.0 metres in zone 2-651. Mineralization consists of 5% disseminated pyrite and up to 3% pyrrhotite in a silica-biotite-sericite altered andesite.

OSK-OB-18-043 intersected 10.9 g/t Au over 6.3 metres in zone 2-650. Mineralization consists of local visible gold on the margin of quartz-carbonate-chlorite veins, up to 7% disseminated pyrite, trace chalcopyrite and sphalerite in an andesite with a penetrative silica and potassic alteration.

OSK-OB-18-051 intersected 37.0 g/t Au over 5.4 metres in zone 2-652. Mineralization consists of 2% pyrite stringers and trace chalcopyrite stringers in a strongly sericitized porphyritic rhyodacite with weak chloritization.

OSK-OB-18-055 intersected 11.8 g/t Au over 3.0 metres in zone 2-651. Mineralization includes up to 5% pyrite clusters in association with dismembered quartz-chlorite-carbonate veinlets, 2% pyrite stringers, 2% pyrrhotite clusters and trace chalcopyrite in an andesite with moderate sericitization and carbonatation.

OSK-OB-18-057 intersected 26.4 g/t Au over 2.1 metres in zone 2-650. Mineralization consists of up to 6% disseminated pyrite in an andesite strongly altered in sericite, biotite and chlorite.

OSK-OB-18-064 intersected 7.26 g/t Au over 3.4 metres in zone 2-651. Mineralization consists of up to 4% pyrite and 1% pyrrhotite in clusters and stringers and trace pyrite associated with dismembered quartz-chlorite-carbonates veinlets in a strongly sericitized andesite.

OSK-OB-18-069 intersected 6.18 g/t Au over 9.0 metres in zone 2-652. Mineralization consists of 3% pyrite, trace pyrrhotite and trace chalcopyrite as clusters and in association with quartz-carbonate veins. Mineralization is hosted in silica and sericite altered quartz-phyric rhyodacite.

OSK-OB-18-070 intersected 14.2 g/t Au over 3.3 metres and 38.0 g/t Au over 2.1 metres in zone 2-652. Mineralization consists of 2% pyrite dissemination, 1% sphalerite at the margin of quartz-carbonate veins in a moderately sericitized rhyodacite.

OSK-OB-18-073 intersected two intervals: 8.20 g/t Au over 4.1 metres and 29.4 g/t Au over 2.6 metres in zone 2-652. The first interval contains 5% of interstitial pyrite, locally trace to 20% chalcopyrite at the contact between a sericitized rhyodacite and a chloritized andesite. The second interval contains local visible gold associated with 2% pyrite and 1% chalcopyrite in stringers and clusters in a quartz-phyric rhyodacite with sericite and biotite alteration.

OSK-OB-18-075 intersected 19.6 g/t Au over 3.0 metres in zone 2-652. Mineralization consists of local visible gold, 8% pyrite, 1% sphalerite and trace disseminated chalcopyrite in a strongly sericitized and silicified porphyritic rhyodacite.

OSK-OB-18-077 intersected 8.28 g/t Au over 2.3 metres in zone 3-653. Mineralization consists of 5% chalcopyrite, 2% pyrite and trace sphalerite in a sericitized andesite.

OSK-OB-18-082 intersected 3.32 g/t Au over 6.0 metres in zone 3-653. Mineralization consists of 3% pyrite stringers and clusters, trace chalcopyrite in stringers hosted in quartz porphyritic rhyodacite.

OSK-OB-18-086 intersected 41.1 g/t Au over 2.4 metres in zone 3-551. Mineralization consists of up to 5% pyrite stringers, 1% disseminated chalcopyrite and trace sphalerite in a strongly sericitized quartz-phyric rhyodacite.

OSK-OB-18-088 intersected 3.90 g/t Au over 6.7 metres in zone 3-654 and 11.0 g/t Au over 3.1 metres in zone 3-653. The first interval contains up to 6% pyrite and 2% chalcopyrite in stringers hosted in an andesite altered in biotite and sericite. The second interval contains local visible gold, 2% pyrite stringers and 1% sphalerite in chlorite-carbonate veinlets. Mineralization is hosted in a strongly sericitized and silicified porphyritic rhyodacite.

OSK-OB-18-098 intersected 13.4 g/t Au over 2.4 metres in zone 3-652. Mineralization consists of 1% disseminated pyrite and stringers in sericite and chlorite altered quartz-phyric rhyodacite.

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared and approved by Mr. Pascal Simard, P.Eng. (OIQ 5002937), Director of Northern Exploration for projects in Quebec, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Control and Reporting Protocols

True width determination is currently unknown but is estimated at 65-80% of the reported core length interval for the zone. Assays are uncut except where indicated. Intercepts occur within geological confines of major zones but have not been correlated to individual vein domains at this time. Reported intervals include minimum weighted averages of 3.0 g/t Au diluted over core lengths of at least 2.0 metres. All NQ core assays reported were obtained by either 1-kilogram screen fire assay or standard 50-gram fire-assaying-AA finish or gravimetric finish at (i) ALS Laboratories in Val d’Or, Québec, Thunder Bay, Ontario, Sudbury, Ontario or Vancouver, British Columbia. The 1-kilogram screen assay method is selected by the geologist when samples contain coarse gold or present a higher percentage of pyrite than surrounding intervals. All samples are also analyzed for multi-elements, using an Aqua Regia-ICP-AES method at ALS Laboratories. Drill program design, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results is performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QA/QC purposes by the Corporation as well as the lab.

About the Osborne-Bell Gold Deposit

The Osborne-Bell gold deposit is located 15 kilometres northwest of the town of Lebel-sur-Quevillon in the Abitibi region of Québec, Canada. The mineral resource defined by Osisko, as disclosed in the Osborne-Bell Technical Report (as defined below), comprises 2,587,000 tonnes at 6.13 g/t Au (510,000 ounces) in the inferred mineral resource. Mineralization occurs in nine (9) individuals mineralized zones:1-551, 1-651, 1-653, 2-650, 2-652, 3-551, 3-552, 3-652, 3-653. All zones comprise sub-vertical lenses following intermediate and felsic volcanic rocks plunging to the northeast. The deposit is well defined from surface to a depth of 300 metres. For details regarding the key assumptions, parameters and methods used to estimate the mineral resources presented in respect of the Osborne-Bell gold project, please see the technical report entitled “Technical Report and Mineral Resource Estimate – Osborne-Bell deposit, Quévillon property ” and dated April 23, 2018 (effective date of March 2, 2018), which has been prepared by InnovExplo Inc. from Val-d’Or, Québec (the “Osborne-Bell Technical Report”). The Osborne-Bell Technical Report is available on Osisko’s website at www.osiskomining.com and on SEDAR under Osisko’s issuer profile at www.sedar.com. For details regarding the PEA refer to “Preliminary Economic Assessment of the Windfall Lake Project, Lebel-sur-Quévillon, Québec, Canada” and dated August 1, 2018 (effective date of July 12, 2018), has been prepared for Osisko by BBA Inc., InnovExplo Inc., Golder Associates Ltd., WSP Canada Inc. and SNC-Lavalin Stavibel Inc. (the Windfall PEA). The Windfall PEA which includes the Osborne Bell Deposit is available on SEDAR (www.sedar.com) under Osisko’s issuer profile.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100% undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 3,300 square kilometres), a 100% interest in the Marban project located in the heart of Québec’s prolific Abitibi gold mining district, and properties in the Larder Lake Mining Division in northeast Ontario, including the Jonpol and Garrcon deposits on the Garrison property, the Buffonta past producing mine and the Gold Pike mine property. The Corporation also holds interests and options in a number of additional properties in northern Québec and Ontario.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains the forward-looking information pertaining to, among other things, the timing and ability of Osisko to file a technical report in respect of this resource estimate; the prospects of the Osborne-Bell gold deposit; the potential for the Osborne-Bell gold deposit being a significant deposit; the potential future mill site for the Windfall Lake gold deposit; the timing and ability of Osisko, if at all, to publish a resource update for Windfall-Lynx; the projected capital expenditures of mining activities at the Osborne-Bell gold deposit; upgrading a inferred mineral resource to a measured mineral resource or indicated mineral resource categories; the significance of historic exploration activities and results. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Osisko to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including drilling; property interests in the Quévillon project and the Osborne-Bell Gold Deposit; the ability of the Corporation to obtain required approvals; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski

President and Chief Executive Officer

Telephone: (416) 363-8653

OSISKO CO-FOUNDER ROBERT WARES DONATES $5 MILLION TO McGILL

(Toronto, September 27, 2018) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) is proud to recognize and congratulate Robert Wares, one of the original founders of the Osisko group companies on the announcement of his donation of $5 million to McGill University in Montréal, Québec. The following is an excerpt from yesterday’s McGill press release.

As an entrepreneurial geologist, Bob Wares, (BSc’79, DSc’12), became a mining rock star when he discovered one of Canada’s largest gold deposits in the Abitibi region of Quebec. Now, he is bringing that Midas touch to his alma mater in the form of a landmark $5 million gift that will support research programs, fellowships, innovative research, a lecture series and outreach efforts in McGill University’s Faculty of Science, with a particular focus on his home department, Earth and Planetary Sciences (EPS).

The gift will provide immediate impact for students and faculty in five targeted areas:

– the Wares Science Innovation Prospectors Fund, designed to support innovative, high-risk research by funding up to four promising projects a year from researchers across the Faculty of Science;

– a Recruitment and Outreach Coordinator Fund, supporting the activities of a coordinator to liaise with CEGEPs and high schools in an effort to attract more students to EPS studies at McGill;

– the Wares Field Study Fund, supporting field studies in Canada and abroad for EPS students;

– the Wares Postdoctoral Fellowships, which will provide funding for up to four EPS postdoctoral fellows each year pursuing earth science research.

– an Annual Lecture Fund, to bring globally renowned keynote speakers to Montreal to discuss earth science topics or areas of research.

“We would like to thank Bob Wares for this exceptional gift and for his continued support of McGill,” said Suzanne Fortier, Principal and Vice-Chancellor of McGill University. “This donation will make an immediate impact on our Faculty of Science and will greatly enhance important research, education and out-of-classroom student experiences in the Department of Earth and Planetary Sciences.

A graduate of EPS, Wares has been a longtime supporter of McGill, contributing to the Faculties of Science and Medicine. In 2009, Wares and his company, Osisko Mining Corporation, contributed $4.1 million to endow two faculty research awards, undergraduate and graduate level scholarships and a field trip fund in the Department of Earth and Planetary Sciences, with part of the gift matched by the J.W. McConnell Family Foundation. Wares has supported McGill every year since 2009 and his latest gift brings his total McGill support to date to over $10 million. As a volunteer and member of the Faculty of Science Advisory Board, he has also been exceptionally generous with his time and insights.

“Bob has had a tremendous impact on our Faculty and I am grateful for his involvement, his ideas, and his perspective as a business leader,” said Bruce Lennox, Dean of the Faculty of Science. “His continuing commitment to our students and researchers is an invaluable asset, particularly to Earth and Planetary Sciences.”

A mining industry leader and innovator, Wares has been dubbed a ‘rock star’ in the field because of his remarkable success in assessing, finding and launching various mining exploration projects over the course of his 40-year career. Together with two associates, he founded Osisko Mining Corporation in 2003, and, against all odds, the fledging company eventually developed the Canadian Malartic mine, which, to this day, remains the largest single gold producer in Canada, with initial reserves of 11 million ounces of gold. In 2012, Wares received an Honorary Doctorate from McGill in recognition of his achievements in the field of applied economic geology.

“I’m very pleased to have this opportunity to support McGill, the Faculty of Science and EPS,” said Wares, who is currently Executive Vice-President of the new Osisko Mining and Executive Chairman of Osisko Metals. “I’m particularly pleased to support field trips and experiential education, which are so important to students in Earth and Planetary Sciences.”

OSISKO MINING CLOSES $76.4 MILLION “BOUGHT DEAL” PRIVATE PLACEMENT OF FLOW THROUGH SHARES AND COMMON SHARES, INCLUDING UNDERWRITERS’ OPTION

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

(Toronto, September 18, 2018) – Osisko Mining Inc. (TSX:OSK) (“Osisko” or the “Corporation”) is pleased to announce, further to its announcements on August 15, 2018 and August 16, 2018, that it has completed a “bought deal” brokered private placement of (i) an aggregate of 27,046,031 common shares of the Corporation that will qualify as “flow-through shares” (within the meaning of subsection 66(15) of the Income Tax Act (Canada) and, where applicable, section 359.1 of the Taxation Act (Québec)) (“Flow-Through Shares”) for aggregate gross proceeds of approximately $69.9 million, and (ii) an aggregate of 3,823,000 common shares of the Corporation (“Common Shares”) at an issue price of $1.70 per Common Share for aggregate gross proceeds of approximately $6.5 million, including the exercise in full of the underwriters’ option (the “Offering”). The Flow-Through Shares were issued in two tranches, whereby the first tranche consisted of 14,035,088 Flow-Through Shares at an issue price of $2.85 per “tranche one” Flow-Through Share and the second tranche consisted of 13,010,943 “tranche two” Flow-Through Shares at an issue price of $2.30 per Flow-Through Share. The total proceeds of the Offering are approximately $76.4 million.

The Offering was led by Canaccord Genuity Corp. on behalf of a syndicate of underwriters that included Haywood Securities Inc., Macquarie Capital Markets Canada Ltd. and National Bank Financial Inc.

The gross proceeds from the sale of Flow-Through Shares will be used by the Corporation to incur eligible “Canadian exploration expenses” that will qualify as “flow-through mining expenditures” (within the meaning of Income Tax Act (Canada)) related to Osisko’s projects in Québec on or prior to December 31, 2019 for renunciation to subscribers of Flow-Through Shares effective December 31, 2018. The net proceeds from the sale of Common Shares will be used to fund exploration activities and for general corporate purposes.

All securities issued under the Offering will be subject to a hold period expiring four months and one day from the date hereof. The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

The following “insiders” of the Corporation have subscribed for Flow-Through Shares under the Offering:

| Insider | Insider Relationship | Flow-Through Shares Purchased

(#) |

Subscription Amount

($) |

| John Burzynski | Director and Senior Officer of Osisko; Director of 10% Securityholder of Osisko | 25,000 | $57,500 |

| Sean Roosen | Director of Osisko; Director and Senior Officer of 10% Securityholder of Osisko | 75,000 | $172,500 |

| José Vizquerra | Director and Senior Officer of Osisko | 25,000 | $57,500 |

| Robert Wares | Senior Officer of Osisko | 500,000 | $1,150,000 |

| Bryan Coates | Senior Officer of 10% Securityholder of Osisko | 65,500 | $150,650 |

| Mathieu Savard | Senior Officer of Osisko | 10,000 | 23,000 |

| André Gaumond | Director of 10% Securityholder of Osisko | 122,310 | $281,313 |

| Totals | 822,810 | $1,892,463 |

Each subscription by an “insider” is considered to be a “related party transaction” for purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“). Pursuant to MI 61-101, the Corporation has filed a material change report providing disclosure in relation to each “related party transaction” on SEDAR under Osisko’s issuer profile at www.sedar.com. The Corporation did not file the material change report more than 21 days before the expected closing date of the Offering as the details of the Offering and the participation therein by each “related party” of the Corporation were not settled until shortly prior to the closing of the Offering, and the Corporation wished to close the Offering on an expedited basis for sound business reasons. The Corporation is relying on exemptions from the formal valuation and minority shareholder approval requirements available under MI 61-101. The Corporation is exempt from the formal valuation requirement in section 5.4 of MI 61-101 in reliance on section 5.5(a) of MI 61-101 as the fair market value of the transaction, insofar as it involves interested parties, is not more than the 25% of the Corporation’s market capitalization. Additionally, the Corporation is exempt from minority shareholder approval requirement in section 5.6 of MI 61-101 in reliance on section 5.7(b) of MI 61-101 as the fair market value of the transaction, insofar as it involves interested parties, is not more than the 25% of the Corporation’s market capitalization.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100% undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quevillon area (over 3,300 square kilometres), a 100% interest in the Marban project located in the heart of Québec’s prolific Abitibi gold mining district, and properties in the Larder Lake Mining Division in northeast Ontario, including the Jonpol and Garrcon deposits on the Garrison property, the Buffonta past producing mine and the Gold Pike mine property. The Corporation also holds interests and options in a number of additional properties in northern Québec and Ontario.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the use of proceeds of the Offering; the timing and ability of the Corporation, if at all, to obtain final approval of the Offering from the Toronto Stock Exchange; the tax treatment of the Flow-Through Shares; the timing of the tax renunciation to the subscribers; objectives, goals or future plans; statements regarding exploration results and exploration plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, capital and operating costs varying significantly from estimates; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; the other risks involved in the mineral exploration and development industry; and those risks set out in the Corporation’s public documents filed on SEDAR at www.sedar.com. Although the Corporation believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Corporation disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

For further information please contact:

John Burzynski

President and Chief Executive Officer

Telephone: (416) 363-8653

OSISKO WINDFALL DEEP DRILLING CONFIRMS TRIPLE 8 DISCOVERY

17.4 g/t Au Over 13.7 Metres (including 26.3 g/t Au over 6.5 Metres)

6.31 g/t Au Over 12.5 Metres (including 21.1 g/t Au Over 3.2 Metres)

(Toronto, September 13, 2018) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) is pleased to provide new results from the ongoing deep-hole program at its 100% owned Windfall Lake gold project located in the Abitibi greenstone belt, Urban Township, Eeyou Istchee James Bay, Québec.

In May 2018 Osisko commenced two deep exploration drill holes (“Deep Underdog” and “Deep Lynx”) to investigate the potential for depth extensions of the Lynx and Underdog mineralized zones, as well as to further test the intrusion-related geological model for the Windfall deposit at depths of approximately 2000 metres to 2500 metres from surface.

New drilling has confirmed and expanded the Triple 8 discovery (see Osisko news release dated July 11th, 2018). Wedge hole OSK-W-18-1603-W2 intersected a zone of sericite and silica alteration over 85 metres containing sulfides and zones of gold mineralization from approximately 1485 metres to approximately 1570 metres downhole. This alteration zone includes two significant gold bearing intervals located between approximately 1510 to 1554 metres downhole. The new wedge extends the Triple 8 zone by 50 metres to the south from the discovery hole OSK-W18-1603. Triple 8 geometry is still being interpreted, however the zone appears to remain open in all directions. Previously drilled wedge OSK-W-18-1603-W1 intersected a fault zone and porphyritic intrusive in the anticipated Triple 8 area. Maps and sections showing the location of the two new wedges and their relation to the Triple 8 discovery are provided on the Corporation’s website. The Triple 8 Zone falls well outside the area of the recently announced Windfall mineral resource estimate (see Osisko news release dated May 14th, 2018).

Osisko President and CEO John Burzynski commented: “Today’s follow-up results from the new wedge hole in the Triple 8 discovery are a great confirmation that there is significant high-grade gold at depth in the Windfall intrusive system. What we find very exciting is that the Triple 8 alteration zone now extends over 85 metres wide, on a scale we haven’t seen before at Windfall, indicating that we may be approaching a main source of the mineralizing system. We are confident that as we progress with drilling the deeper sections of the Windfall deposit we will continue to have discovery success.”

Sericite and silica alteration begins within the host andesite and gabbro package at approximately 1434 metres, increasing in intensity to a strongly altered zone between 1485 metres to 1570 metres. Alteration is found peripheral to a felsic stock dipping 40° to the north-east and shows the same chlorite – biotite +/- garnet alteration encountered in the Triple 8 discovery hole. Exact geometries and relationships between the mineralization and the emplacement of the felsic stock have yet to be determined. The Triple 8 Zone appears to be sub-vertical with a 70 degree dip and is oriented NNE at 030 degrees. Mineralization consists of semi-massive and stringer pyrite with local visible gold and strong silica alteration. The zones contain minor sphalerite, chalcopyrite, pyrrhotite, and trace arsenopyrite. A number of minor mineralized intervals were encountered in the hanging wall and the footwall of the main mineralized corridor (assays pending).

Today’s results include the currently available significant analytical results from OSK-18-1603-W2. Maps showing the drill hole location and analytical results are available at www.osiskomining.com.

| Hole No. | From

(m) |

To

(m) |

Interval

(m) |

Au (g/t)

uncut |

Au (g/t)

cut to 100 g/t |

Mineralized Area |

| OSK-W-18-1603-W2 | 1510.3 | 1524.0 | 13.7 | 17.4 | Triple 8 | |

| including | 1510.3 | 1512.8 | 2.5 | 23.2 | ||

| including | 1517.5 | 1524.0 | 6.5 | 26.3 | ||

| OSK-W-18-1603-W2 | 1538.4 | 1550.9 | 12.5 | 6.31 |

Triple 8 |

|

|

including |

1547.7 | 1550.9 | 3.2 | 21.1 |

| Hole Number | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | Section |

| OSK-W-18-1603-W2 | 35 | -80 | 1741.0 | 453340 | 5434543 | 3275 |

OSK-W-18-1603-W2

Gold mineralization in the main alteration corridor (1485 metres to 1570 metres downhole) is hosted in a pervasive altered andesite and is subdivided into two intervals which correspond to the Triple 8 Zone. The first interval, from 1510.3 metres to 1524.0 metres is hosted in strong pervasive silica and moderate sericite alteration. Mineralization consists of up to 35% pyrite stringers, local semi-massive pyrite, trace chalcopyrite, sphalerite, arsenopyrite and local visible gold. The second interval extends from 1538.4 metres to 1550.9 metres and contains up to 30% pyrite stringers, up to 20% pyrite-tourmaline veins, trace sphalerite and local visible gold within a strong silica and moderate sericite altered andesite.

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared and approved by Mr. Louis Grenier, M.Sc.A., P.Geo. (OGQ 800), Project Manager of the Windfall Lake gold project, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Control and Reporting Protocols

True width determination for the Triple 8 Zone is currently undetermined but is estimated at 65-80% of the reported core length intervals. Assays are uncut except where indicated. Intercepts occur within geological confines of a major zone but have not been correlated to individual vein domain at this time. All NQ core assays reported were obtained by either 1-kilogram screen fire assay or standard 50-gram fire-assaying-AA finish or gravimetric finish at (i) ALS Laboratories in Val d’Or, Québec, Thunder Bay, Ontario, Sudbury, Ontario or Vancouver, British Colombia, or (ii) Bureau Veritas in Timmins, Ontario. The 1-kilogram screen assay method is selected by the geologist when samples contain coarse gold or present a higher percentage of pyrite than surrounding intervals. Selected samples are also analyzed for multi-elements, including silver, using an Aqua Regia-ICP-AES method at ALS Laboratories. Drill program design, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results are performed by a “qualified person” employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QA/QC purposes by the Corporation as well as the lab. Approximately 5% of sample pulps are sent to secondary laboratories for check assay.

About the Windfall Lake Gold Deposit

The Windfall Lake gold deposit is located between Val-d’Or and Chibougamau in the Abitibi region of Québec, Canada. The mineral resource defined by Osisko comprises 2,382,000 tonnes at 7.85 g/t Au (601,000 ounces) in the indicated resource category and 10,605,000 tonnes at 6.70 g/t Au (2,284,000 ounces) in the inferred resource category. See the technical report, entitled “Technical Report and Mineral Resource Estimate for the Windfall Lake Project, Windfall Lake and Urban-Barry Properties” and dated June 12, 2018 (effective date of May 14, 2018), which has been prepared for Osisko by InnovExplo Inc. from Vald’Or, Québec, and is available on SEDAR (www.sedar.com) under Osisko’s issuer profile. The Windfall Lake gold deposit is currently one of the highest grade resource-stage gold projects in Canada. Mineralization occurs in four principal zones: Lynx, Zone 27, Caribou, and Underdog. All zones comprise sub-vertical lenses following intrusive porphyry contacts plunging to the northeast. The deposit is well defined from surface to a depth of 900 metres and remains open along strike and at depth. Mineralization has been identified only 30 metres from surface in some areas and as deep as 1,200 metres in others, with significant potential to extend mineralization down-plunge and at depth.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100% undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quevillon area (over 3,300 square kilometres), a 100% interest in the Marban project located in the heart of Québec’s prolific Abitibi gold mining district, and properties in the Larder Lake Mining Division in northeast Ontario, including the Jonpol and Garrcon deposits on the Garrison property, the Buffonta past producing mine and the Gold Pike mine property. The Corporation also holds interests and options in a number of additional properties in northern Québec and Ontario.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the Windfall Lake gold deposit being one of the highest grade resource-stage gold projects in Canada; the discovery, grade, mineralization and potential of the Triple 8 Zone, if any; the significance of the deep exploration drill holes,(including the new wedge holes described in this news release, if any; the openness of the Triple 8 Zone; the correlation with the Triple 8 Zone with any known zone; the significance of management’s geological modelling and interpretation of interim drill results; the significance of new results from the ongoing drill program at the Windfall Lake gold project; the significance of assay results presented in this news release; the type of drilling included in the drill program (definition, expansion and exploration drilling in and around the main Windfall Lake gold deposit and the adjacent Lynx deposit, and exploration drilling on the greater deposit and Urban-Barry project area); potential mineralization; the potential to extend mineralization up and down-plunge and at depth at the Windfall Lake gold deposit; the ability to realize upon any mineralization in a manner that is economic; the ability to complete any proposed exploration activities and the results of such activities, including the continuity or extension of any mineralization; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. While this forward-looking information is based on reasonable assumptions and estimates of management as of the date hereof, such forward-looking information inherently involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Osisko to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including drilling; property interests in the Windfall Lake gold project; the ability of the Corporation to obtain required approvals and complete transactions on terms announced; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions. Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information, Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski. President and Chief Executive Officer

Telephone: (416) 363-8653

INTERIM ORDER OBTAINED FOR OSISKO MINING’S ACQUISITION OF BEAUFIELD

![]()